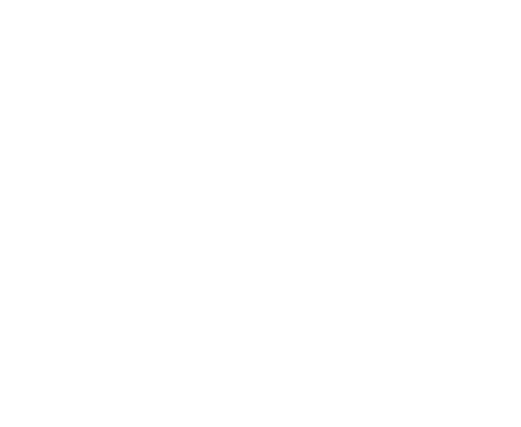

Kirkwood, MO Property Taxes Compared to Other St. Louis Suburbs

Kirkwood, MO — How Do Property Taxes Compare To Other Areas?

Property taxes are one of those topics buyers do not always think about until they are deep into the home search. In a desirable community like Kirkwood, it is a very important conversation.

Kirkwood property taxes are generally somewhat higher than many other St. Louis County suburbs. This is due to the strength of local services, the community’s long-standing desirability, strong schools, beautiful neighborhoods, and the consistent investment residents make in maintaining homes and infrastructure.

When I talk with buyers looking in Kirkwood, we break down what those taxes support. Homeowners benefit from local amenities, schools with strong reputations, city services, parks, and community engagement. Many residents feel the tax rate is justified because quality of life remains high.

Higher taxes also tend to support property values. Kirkwood has historically been one of the more stable and resilient markets in the area, even when broader conditions shift.

That being said, property tax impact definitely matters when creating a realistic budget. I always help buyers evaluate their full financial picture, not only the mortgage payment. Understanding taxes upfront prevents surprises and helps buyers confidently choose neighborhoods and price ranges.

If you’re considering Kirkwood and want help evaluating property taxes as part of your decision-making process, I’d be more than happy to walk through the numbers with you.

— Krista Hartmann

Selling Your Home?

Get your home's value - our custom reports include accurate and up to date information.

%201.png)